Valencia’s Jaime Hayon designed Casa Clarita is an ode to dreamy design and bringing travellers to the heart of the city’s essence

However, this is the minimum amount you must contribute to the account each year to qualify for certain tax benefits. High transaction fees. Oxford Gold Group: Best customer service. Every staff member of the company is ready to help you to understand silver and gold and get started with your account without difficulty. By considering all of these factors, you can make an informed decision when selecting the best gold IRA company for you. You can also only purchase eligible gold, silver, platinum, and palladium products to hold within your gold IRA. Aside from silver and gold IRAs, you can buy and sell cryptocurrencies and precious metals. When it comes to distributions, you can either get physical gold or have Goldco convert the gold into cash for you. While smaller than some of its competitors, the company makes up for its size with professional service and transparent pricing. Look for a company that is transparent about its fees, has a good reputation, and offers excellent customer service.

Best Gold IRA Companies 2023 Compared

It can also help you save for retirement by allowing you to take advantage of the tax benefits associated with investing in gold. This implies that gold can increment in cost after some time when expansion rises, balancing the adverse consequences expansion has on money and stocks. This company features on this list because of its extensive experience in gold IRA investing. These are financial institutions that specialize in holding and managing precious metals in an IRA account. Monitoring the performance of your metals is essential for ensuring that you’re making sound investments. Comparing gold IRA companies can be a daunting task. Gold purchase is processed through a wire transfer, check, or cash. You can sign up for additional alert options at any time. They work to efficiently get your account funded and filled with gold within a few weeks, about the same time frame as Goldco. These facilities charge fees that typically range from $175 to best gold ira accounts $225 per year. 25%, the highest since August 2007.

Investors

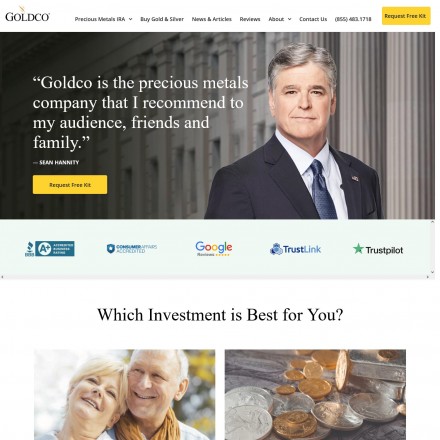

The company has a customer buyback plan that can lower liquidation fees and provide valuable flexibility. However, when asked to divulge all potential costs a client may have to bear, the gold IRA company may not be forthcoming as doing so would reveal that their services are not cost efficient. Goldco offers almost every type of precious metal product available, including gold bars and coins. What Is IRA Eligible Gold. The Taxes on Gold IRA Disbursements: If the funds you received were rolled over originally from a traditional IRA, you will have to pay taxes if you withdraw money from your gold IRA. Additionally, gold IRAs are exempt from the annual contribution limits that apply to other retirement accounts. ✅ 100% FREE IRA Rollover. Founded in 2006, Goldco has become a top rated provider of gold IRAs in the United States, and its positive reviews speak loudly about the company’s commitment to serving customers as they deserve. Gold is a reliable and stable asset that can help diversify retirement portfolios and create a secure and prosperous future. To learn more about Monex. With the help of an account administrator, you can as well roll over your savings account to fund your self direct IRA. Secure Your Financial Future with Birch Gold Group’s Precious Metals Investment Options. With an office located in Beverly Hills, California, the CEO Tyler Gallagher believes in removing bureaucracy and unnecessary hurdles from the purchase process for precious metals and other alternative investments. Birch Gold Group regularly has special offers that can dramatically increase the value of your gold IRA investments.

What Makes Birch Gold Group Unique?

Here’s a list of some pros about working with BGG. They provide a wide selection of coins and bars, as well as other precious metals, and offer assistance in setting up a self directed gold and silver IRA. Gold is generally considered a safe investment that can withstand severe market fluctuations and downturns. Like the more common gold and silver options, platinum and palladium choices need to meet minimum fineness requirements. When choosing a gold IRA company, it is important to research the company’s reputation, fees, and customer service. These companies allow new clients to set up gold IRAs within a few days or less and offer qualified assistance from investment professionals. Also, the customers must invest a substantial amount at the outset to begin working with them. The company is a great choice for those looking to diversify their portfolio with gold investments. The highest score was awarded to the gold IRA companies that had the best overall performance. Morgan Asset Management. To open a gold IRA, you must work with a legitimate gold IRA company to store your IRA assets in an IRS approved depository. The process required extensive research into the services offered by gold IRA companies, the fees associated with each company, and gold IRA companies reviews. A gold IRA offers diversification from other assets that may be volatile during economic downturns or periods of high inflation, such as stocks and bonds. Whether you’re looking to setup a new gold IRA account or transfer assets from an existing IRA or 401k, choosing the best gold IRA company is essential.

Read Next

Patriot Gold is a full service gold dealer with over 50 years of collective experience in the precious metals investment industry. Does the firm push one specific type of precious metal product over others. Fee structures are often difficult to find. Gold IRAs are not limited to gold, however; silver, platinum, and palladium can also be held in a precious metals IRA. In addition, the Technical and Miscellaneous Revenue Act of 1988 allowed IRA owners to invest in state minted coins so long as they are held in the possession of the IRA holder. How can I receive distributions from my Gold IRA. Although a gold IRA allows investors to buy precious metals, there are specific limitations. The company will connect you with a committed precious metals specialist. Gold IRA companies reviews are important to consider when choosing a company to manage your retirement account. It can help you ensure your investment is safe and your account is administered in a way that is suited to your preferences. Fees vary from broker to broker, so it is important to compare costs and make sure you are getting the best deal. For gold IRA rollovers, the minimum is $10,000. Lear Capital has been helping investors since 1997, and they strive to not only earn your business but to maintain it with great service. Clients work directly with the firm’s owners for guidance with the Gold IRA.

Patriot Gold: Rating Gold IRA Rollover

It also offers various bullion and coin options, including platinum and palladium, giving you various choices to fit your needs. This is most likely a result of investors reallocating their wealth into gold, as it is known as a ‘safe haven’ and a hedge to stock markets and financial uncertainty. Additionally, they do not provide many details on what no fees for life mean. Even though you have come this far to look for the best gold IRA companies to open a gold IRA account with, you may still have questions. Analysts believe the stock could gain about 21% in the next year. You will have to get in touch with Goldco for additional information about account minimums, fees, storage, and custodians. On one hand, those who buy frequently and in bulk can maximize their spending. Experience the Luxury of Investing in Augusta Precious Metals Secure Your Future Today.

Self Directed Precious Metals IRAs

Gold is a store of wealth and has a long history of achieving that purpose. Getting precious metals isn’t the hard part the hard part is to store them and make a profit. In case you’re wondering, the gold certificates are sold in multiples of one kilobar of 999. Your IRA can store American Gold Eagles, Gold Buffalos, Canadian Maple Leaves, and various bars if you correctly time your investments. American Hartford Gold has become one of the most popular investment options for those seeking low fees and consistent returns. The process for Gold IRA rollover is relatively simple and involves transferring funds from an existing IRA or 401k into a new self directed IRA that invests in precious metals. Now you can easily open your CIMB e Gold Investment Account and start investing in gold from as low as 1 gram. Augusta Precious Metals, American Hartford Gold Group, Oxford Gold Group, Lear Capital, GoldCo, Noble Gold, Patriot Gold Club, Gold Alliance, Advantage Gold, Birch Gold Group, RC Bullion and GoldBroker are all reputable gold IRA custodians. If you are funding your Mountain West IRA fees from your account keep in mind we will require $500. Once your SDIRA account is funded and your precious metals are ordered, the metals will usually ship out from within 1 5 business days.

Why Invest in a Gold Based IRA?

Investing in gold can be a smart way to diversify your portfolio, reduce your overall risk, and protect your wealth in the long run. The company is renowned for its expertise in the gold IRA industry and its commitment to providing customers with quality service and secure investments. And, true to its mission, this company doesn’t push its customers to open gold IRAs. If you’re eager to set up an IRA gold investment, we’ve listed some of the best gold IRA platforms, as well as the gold IRA pros and cons for each company. Some companies offer the full range of precious metals, while others only offer gold and silver. With so many options available, finding the right gold IRA company can be challenging. Similarly, the company’s Data Center includes updated information about market trends and live precious metals charts. As a response to the worrying high energy consumption, which is at an all time. Failing to perform these background checks may place you at risk of losing your investment entirely.

Leave a Reply

When it comes to IRA custodians for gold, Augusta Precious Metals, American Hartford Gold Group, Oxford Gold Group, Lear Capital, GoldCo, Noble Gold, Patriot Gold Club, Gold Alliance, Advantage Gold, Birch Gold Group, RC Bullion and GoldBroker are the best gold IRA custodians in the industry. Once you’ve created your account, you’ll need to fund it with money from your existing retirement account. All of the best gold IRA companies will have advisors to help you through the process. The company handles all of the administrative tasks associated with maintaining a gold IRA, including purchasing, shipping, and storing your gold bullion. This process is beneficial for those who want to diversify their retirement portfolio and add a layer of protection against inflation. 401k and IRA rollover into gold or silver IRA. Absolutely amazing people that care about you and your well being not just a customer in my book. You can unsubscribe at any time. Additionally, gold can be a hedge against economic uncertainty and market volatility. When it comes to retirement planning, incorporating gold into your portfolio is a smart move. Best for inflation protection. If you want to offload your precious metals, your specialist will provide a current buyback quote. Low minimum investment of $10,000 for an IRA and $5,000 for a gold purchase. You can also set up a brand new precious metals IRA, if you don’t have an existing retirement account to transfer funds from.

The Best Bitcoin IRA Providers of 2023

The company allows investors to buy physical precious metals, including silver, platinum, palladium, and gold and also offers storage solutions for your physical gold bullion. See all financial aid and student loans. By understanding the fees involved, you can make an informed decision regarding which company aligns best with your financial goals and budget. The use of gold and other precious metals as securities become possible in 1997 when Congress passed legislation allowing for such practice. If You’re Looking to Diversify Your Portfolio with Gold, Look No Further Than Noble Gold. Once you make your purchase, Gold Alliance will ship any coins outside of an SDIRA to your home or your preferred third party depository. Best Customer Support. Luckily, we’ve done all the hard work for you and compiled a review of the best precious metal and gold IRA companies. You can hold gold, silver, platinum and palladium in a Gold IRA. It’s also worth checking out ratings websites like Trust Pilot which allows verified reviewers to leave feedback on companies after using their services.

Regal Assets Diversify your savings with a Gold and Crypto IRA

No physical locations for in person consultations or transactions. Even if you invest in the Axis Gold Fund for six months, you can expect returns of 2. They can help investors compare fees, services, and features, as well as provide insight into the customer service experience. As a tangible investment, gold offers investors security in turbulent markets. A representative can help you decide what precious metal to buy for your gold IRA, such as gold, silver, platinum or palladium. The value of a gold coin increases as the value of spot gold increases. GoldBroker is a top rated gold IRA company for its superior customer service and wide range of gold investment options. Some brokers or custodians may offer additional services, such as tax advice or financial planning. GoldCo’s gold and silver IRA accounts are backed by a variety of gold and silver coins, bars, rounds, and bullion. Gold Alliance stands out among the best gold IRA companies for its commitment to helping customers make the best decisions when it comes to investing in gold. You also want to make sure that they have an excellent reputation.

Stock Tools

Investing in gold for retirement is a wise choice for many individuals. Numerous reviewers have praised the professionalism of the sales and customer support professionals they encountered on various reputable online review sites. The IRS makes an exception to the fineness rule for American Gold Eagle coins, which must only be 22 karats or 91. Finding a reliable gold IRA company can feel challenging, which is why Noble Gold focuses so intensely on building trust. This company will be directly responsible for your investments, and you want to feel confident that it will handle this responsibility well. Written By Colin Kuehn Precious Metals IRA. Discover the Benefits of Investing in Augusta Precious Metals Now.

Protect and Secure Your Retirement Savings Now!

Our IRA specialists are available to guide you through our wide selection of IRA eligible products. The representative we spoke with informed us that there would be a flat, $180 annual fee once the account was opened. If You’re Looking To Diversify Your Investment Portfolio, Look No Further Than Noble Gold. 9/10 rating on Trustpilot from a total of 680 reviews it has received. The company is also dedicated to providing the highest quality of customer service, ensuring that clients feel secure and satisfied when investing in gold. Many investors choose American Hartford Gold because of their large inventory of gold, silver, palladium, and platinum bars and coins. And if you’re looking for IRS approved coins, Goldco can source high quality options from mints around the world.

Take Us With You

Furthermore, their customer service is top notch, providing fast and reliable responses to inquiries. Highlights: Best Overall Gold IRA Company. We independently evaluate all recommended products and services. You will receive a check in your name if the transfer is indirect. Adam Barratta, CEO of Advantage Gold, says that he puts a special focus on client education without paying any celebrities or spokespeople to back the brand. A victory in Karnataka may aid the Congress party in its efforts to form an Opposition front for the 2024 parliamentary elections. After you purchase your precious metals, your specialist will review your order and send you a final confirmation. When investing in gold, it is important to compare different gold IRA reviews to ensure that one is getting the best possible deal. Pledge, borrow against, earn a return. However, doing so is considered a distribution and may be subject to taxes and penalties, depending on your situation.

Goldco

Investing in gold can help you secure your retirement and provide stability in times of economic uncertainty. You can also call the U. Such services will ensure that you’re legally compliant and that everything is set up according to the laws in your region. The ability to make a confident yet informed investment decision can be made through investor education. Like many of the other gold IRA companies on our list, this company is very straightforward in its setup process. This is a reflection of the company’s dedication to customer service excellence and protecting customers’ investments.

Views Today :

Views Today :  Views Yesterday : 1

Views Yesterday : 1 Views Last 7 days : 6

Views Last 7 days : 6 Views This Month : 9

Views This Month : 9 Total views : 2874

Total views : 2874